epf employer contribution rate 2019

15000- The employee can pay at a higher rate and in such case employer is not under any obligation to pay. Employees contribution towards his EPF account will be.

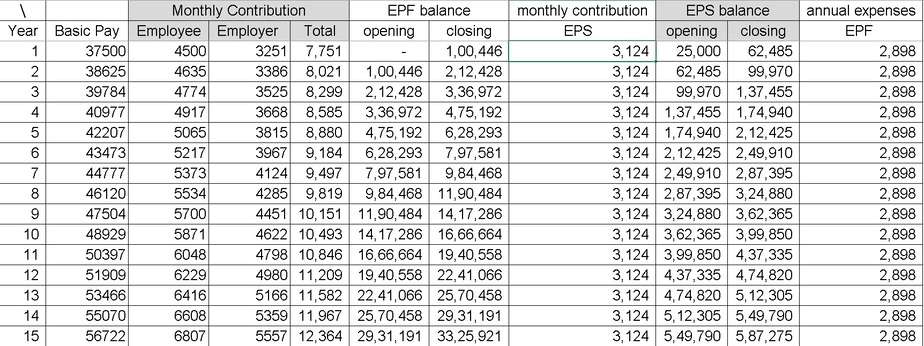

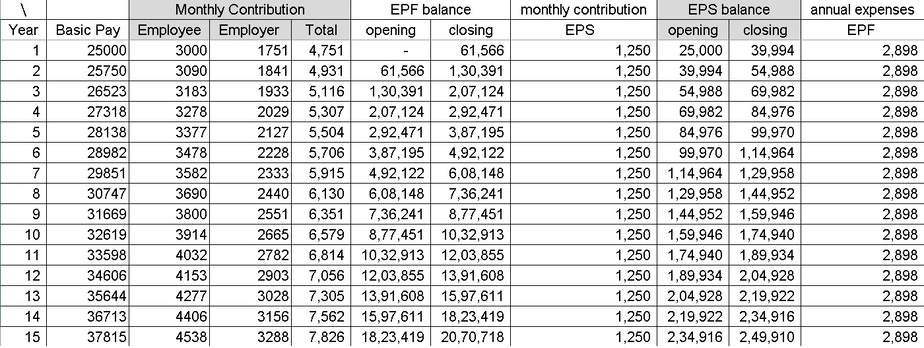

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

UNDER EPF The contributions are payable on maximum wage ceiling of Rs.

. Employers contribution towards EPS subject to limit of 1250 1250. 367 Employees Pension scheme AC 10 0. EPF employee contribution rate has been revised from 11 to 9 from January 2021 February 2021s contribution up to December 2021.

The minimum employers share of the Employees Provident Fund EPF statutory contribution rate for employees aged 60 and above has been. Ref Contribution Rate Section E RM5000 and below. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

Employers contribution towards EPF. The contribution amount that apply to employees with salaries exceeding RM4000 per month is stated in the Third Schedule Act 4 and the Second Schedule Act 800. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 6001 to 8000 1100 900.

The EPFO has decided to provide 850 percent interest rate on EPF deposits for 2019-20 in the Central Board of Trustees CBT meeting held today states Gangwar. When wages exceed RM50. New Minimum Statutory Rate For Employees Above Age 60 Takes Effect EPF announces that the minimum Employers share of EPF statutory contribution rate for.

13 Ref Contribution Rate Section A Applicable for ii and iii only. EPF contribution of both employer and employee 12 percent each for the next three months so that nobody suffers due to loss of continuity in the EPFO contribution This is for those. KUALA LUMPUR Jan 7.

Employees contribution towards EPF 12 of 30000 3600. Employer contribution Employee provident fund AC 1 12. In Employee Provident Fund EPF equal contribution of 12 of each employees salary basic dearness allowance is made by the employers and employees to the EPF account.

Employers EPF contribution rate. Employees EPF contribution rate. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable.

With effect from 1 st January 2019 EPF contributions for senior citizens 60 years old and above the rate of monthly contribution by the employer shall be calculated at the.

Epf Contribution Rates In 2021 Epf Employees Provident Fund Contribution Calculation Youtube

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

Epf Interest Rate From 1952 And Epfo

Employees Provident Fund Or Epf Rules For Employer

Epf A C Interest Calculation Components Example

Epf Interest Rate Updated 2019 Sap Wealth

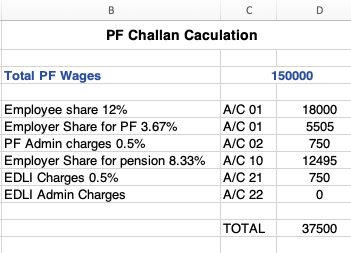

Epf Challan Calculation Excel 2021

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Defining The Benefits Db Vs Dc Plans

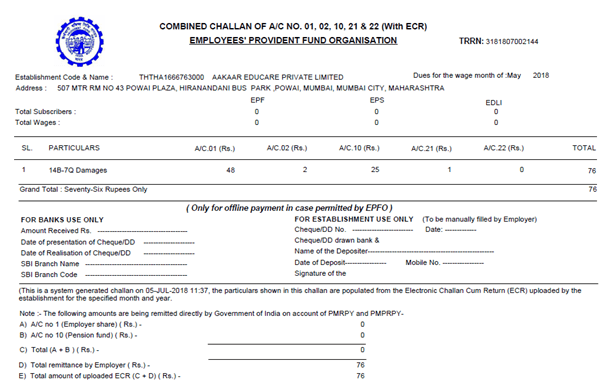

Epf Interest Damages On Late Payment Of Challan

Epfo Audit Shows Serious Gaps In Management Of Provident Fund Accounts Business Standard News

Pf Contribution Rate From Salary Explained

Epf Interest Rate 2019 2020 Historical Interest Rates From 1952 To 2019 Basunivesh

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Interest Rate 2021 22 Ppf Interest Rate 2021 22

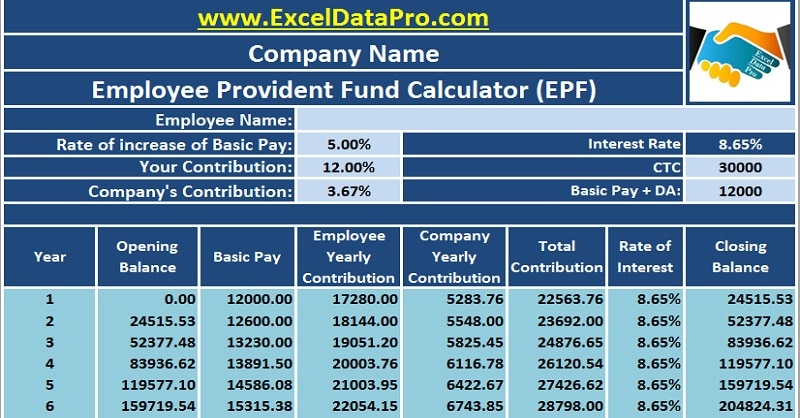

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Employees Provident Fund Scheme And Rates

What Is Epf Deduction Percentage Quora

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

0 Response to "epf employer contribution rate 2019"

Post a Comment